Não é difícil assumir que jogar por dinheiro é realmente lucrativo. Para apostar de verdade, você precisa criar uma página pessoal. O registro no site oficial Pin Up pinup-entrar.com envolve o preenchimento de um pequeno formulário e não leva muito tempo. Você só tem que realizar 2 ações.

Current tax implementation models to defranchise SME participation in the local economy!

By: Kelvin Chisanga

Smart invoice is relatively a good tax model to monitor compliance and foster strong tax fortitude from a general perspective but the current way of implementation methods is forcing many Zambian businesses to face with difficult business situations.

I think it could have been very helpful there was a model of renience to build up confidence and compliance mechanism so that the high level of poverty is slowly cushioned.

Yes, we are all know that Zambia’s tax is narrow and has strong standing limitations in many areas, and the tax basket should play a bigger role given that only a few numbers of tax payers are said to be actively on revenue profile.

However, it is observed that only business with ability to use smart invoice are now conducting serious business activities as applies with the informal sector as well, though this is good but lacks proper methods to help uplift the masses out of unemployment or those who are not compliant with businesses.

This will further breed yet another situation which may tend to be a bad effect on our domestic production and growth, especially for those who are still struggling with backlog of unexplained legacy in taxes but they never understood tax structures pretty well upon registration. Worse off before the new system came on board with smart technology.

So, at the current level of tax complicity and difficulties being faced is now a serious part of hinderances to smooth business especially with regards to the small businesses and individuals who have found tax knowledge a bit complexity in relation to it’s current applicability.

On the hand, there are serious aspect that the system has and I see a numbers of sales invoice will be having issues on vat claims given the situation of having too many credit notes in respect to certain industries like the oil companies where they are currently fighting to be excepted from the use of the system for certain operations.

Smart invoice is a live system which shows money transactions instantly after doing sales invoice which pairs the tax identification number immediately after being issued.

The biggest problem that most businesses have, is that most of the economic players don’t really understand tax structures pretty well, as others are on certain tax like income tax which looks to be a more complicated and expensive tax plan, when in actual sense their businesses are not even supposed to have that type of taxation formula.

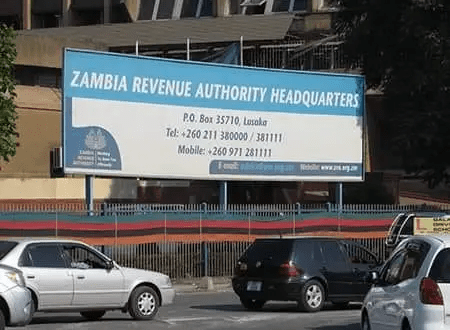

I think Zambia Revenue Authority (ZRA) being a tax agent and implementing revenue house of the ministry of finance and national planning has not dealt with informational and educative components of taxation framework to make corporate citizens to fully understand on most matters of tax.

This being a strong case that we keep witnessing in tax claims, problems in returns and compliance as well as illegal trading through our boarders.

The current tax situations if not well taken of and carefully looked into especially with this excessive force and aggressive way being currently undertaken, will seriously defranchise many ordinary Zambian people away from conducting business activities, we will definitely faced with the hardship in making the cost of living bearable.

Current tax implementation models to defranchise SME participation in the local economy

35 Views

DJ | AUTHOR | JOURNALIST | ECD - DEC

High Credibility News Source : This page adheres to all standards of credibility and transparency. Our page/website services & content, are for informational purposes only.

Leave a comment